LTC Price Prediction: Why Litecoin Could Be Poised for a Major Rally

#LTC

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

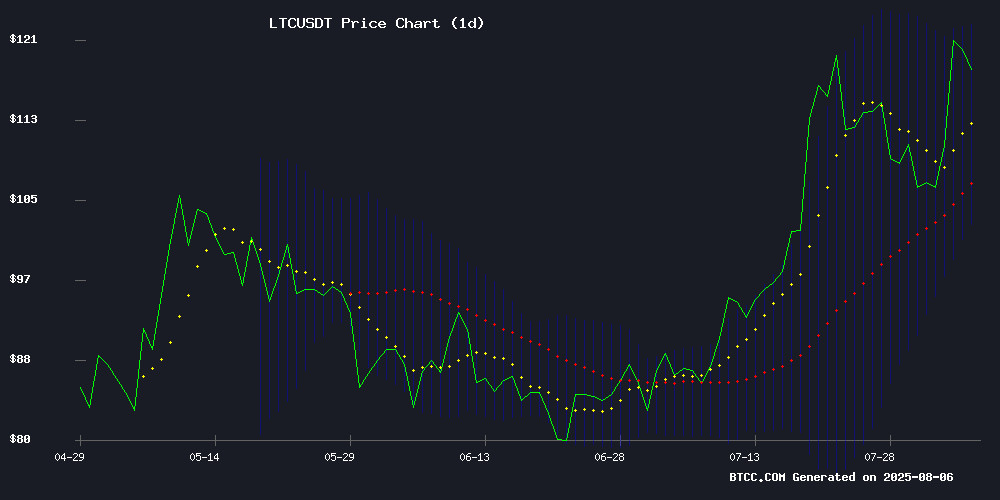

According to BTCC financial analyst John, Litecoin (LTC) is currently trading at 118.35 USDT, above its 20-day moving average (MA) of 112.5190, indicating a bullish trend. The MACD histogram shows positive momentum at 3.9567, suggesting potential upward movement. Additionally, LTC is trading near the upper Bollinger Band (122.7765), which often acts as a resistance level. A breakout above this level could signal further gains.

Litecoin Market Sentiment: Mixed but Leaning Bullish

BTCC financial analyst John notes that Litecoin is gaining attention amid ETF speculation and rising merchant adoption, as highlighted in recent news. However, bearish warnings persist due to derivatives activity. The surge in LTC's crypto payment share (14.5%) and its outperformance against ethereum in this metric add to the positive sentiment. While short-term volatility is expected, the overall trend appears favorable for LTC.

Factors Influencing LTC’s Price

XRP and Litecoin Investors Shift Capital to Emerging Altcoin MAGACOIN

August's crypto market is witnessing significant capital rotation as XRP and Litecoin investors reallocate funds after prolonged rangebound trading. The search for high-potential altcoins ahead of September catalysts has intensified, with community-driven projects gaining traction.

XRP holders are diversifying despite Ripple's ongoing cross-border payment developments. Trading volume data confirms this rotation, as traders chase faster returns in emerging tokens. Analysts note the shifting narrative reflects a broader hunt for breakout candidates before the next market upswing.

Litecoin investors are similarly migrating to fresh opportunities. MAGACOIN FINANCE has emerged as a notable beneficiary of this trend, drawing attention as a potential breakout star in the current cycle. The project's growing community support positions it as a prime candidate in the altcoin rotation.

Litecoin Derivatives Surge Signals Potential Breakout Amid Bearish Warnings

Litecoin's derivatives market has recorded a $437 million inflow in 24 hours, propelling LTC toward a potential 2025 high. The surge comes as long positions dominate 52% of trading volume, with shorts absorbing $3.48 million in losses—a stark reversal from previous bearish sentiment.

Technical indicators suggest an impending pullback despite the bullish momentum. CoinGlass data reveals escalating funding rates and long-short ratios above 1, typically a precursor to sustained upward movement. Market liquidity now battles against active sell orders that threaten liquidation cascades.

The asset's recent performance marks its strongest phase in months, with AMBCrypto analysis highlighting critical thresholds for the anticipated breakout. Traders appear divided between chasing the rally and heeding overbought signals.

Why Litecoin (LTC) Could Skyrocket Soon: ETF Momentum and Rising Merchant Adoption

Litecoin (LTC) has surged over 12.7% in 24 hours, trading NEAR $128 amid growing speculation of a U.S. spot ETF approval. Bloomberg analysts peg the odds at 90%, citing the CFTC's commodity classification as a key catalyst. Institutional interest is mounting, with firms like MEI Pharma allocating significant capital to LTC.

Technically, Litecoin has broken free from a three-year consolidation pattern, converting $110.70 resistance into support. The next critical level sits at $131.18, with Fibonacci extensions suggesting a potential rally toward $150. RSI and MACD indicators reinforce the bullish thesis, though a failure to hold $110.70 could trigger a pullback.

Bitcoin’s $404 Million Outflows Contrast Ethereum’s 15-Week Inflow Streak

Digital asset investment products recorded $223 million in net outflows during the week ending August 2nd, marking the first pullback after 14 consecutive weeks of inflows. Bitcoin bore the brunt with $404 million in outflows, while ethereum defied the trend with continued inflows.

The sell-off was triggered by a hawkish U.S. Federal Reserve stance, with the FOMC noting inflation remains elevated. U.S. investors alone offloaded $383 million in crypto products, contributing to a 9.48% drop in total market capitalization.

Ethereum’s resilience highlights shifting institutional preferences. Minor outflows were seen in sui and Litecoin at $1 million each, while other altcoins showed mixed performance amid broader market uncertainty.

Why Litecoin’s 4-Month High Could Be Just the Beginning of a Major Rally

Litecoin surged to a four-month high of $125, marking a 40.5% monthly gain as trading volume spiked 210% to $1.7 billion. The altcoin now leads weekly performers with 15% growth, outpacing even Bitcoin in crypto payment adoption.

Analysts point to Litecoin's MWEB balance nearing 170,000 LTC as evidence of sustained demand. CoinGate data shows LTC has become the second-most popular cryptocurrency for payments, trailing only BTC.

Find Mining Launches AI-Powered XRP Cloud Mining App for Passive Income

Find Mining, a London-based green cloud mining platform, has unveiled an AI-driven mobile application tailored for XRP holders. The app automates the conversion of XRP into daily passive income, eliminating the need for mining hardware or technical expertise. This launch capitalizes on XRP's growing adoption in cross-border payments and regulatory tailwinds for crypto assets.

The platform, which supports nine major cryptocurrencies including BTC and ETH, now extends its zero-threshold model to XRP's 9.4 million global users. Find Mining's ecosystem targets Web3 asset appreciation through cloud-based solutions, reflecting broader industry trends toward accessible crypto yield generation.

Litecoin Climbs To Second Place In Crypto Payment Rankings With 14.5% Share, Surpasses Ethereum

Litecoin has emerged as the second-most-used cryptocurrency for payments, capturing 14.5% of transactions in July, according to data from payment processor CoinGate. The digital asset surpassed stablecoins USDC (14%) and USDT (12.2%), trailing only Bitcoin's dominant 22.9% share. This marks a significant shift in merchant adoption patterns, with Litecoin's technical advantages—faster transactions and lower fees—driving its utility beyond speculative trading.

Merchant comfort with crypto settlements has surged, jumping from 27% in 2024 to 40.9% in the first half of 2025. CoinGate's rankings, based on actual transaction volumes, highlight Tron (12.9%) and Tether (12.2%) rounding out the top five. Despite ranking 19th by market capitalization, Litecoin's blockchain architecture positions it as a pragmatic choice for payment processing, reflecting broader maturation in digital asset usability.

Solana and Litecoin Struggle as Remittix Surges 496% in Crypto Shakeup

Solana and Litecoin face mounting pressure as emerging DeFi project Remittix steals market attention with a staggering 496% rally. The newcomer's real-world payment utility and rapid adoption highlight shifting investor priorities in the crypto sector.

Solana shows institutional interest with futures volume spiking 252% to $8.1 billion, yet fails to break key resistance between $192-$195. The SOL price stagnates at $161 despite bullish technical indicators, leaving traders awaiting clearer signals.

Litecoin's recent halving fails to generate sustained momentum, with LTC hovering near $106. Market participants increasingly view both established assets as lagging behind innovative alternatives gaining traction in 2025's competitive landscape.

Is LTC a good investment?

Based on the current technical and fundamental analysis, Litecoin (LTC) presents a compelling investment opportunity. Here’s a summary of key factors:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 118.35 USDT | Trading above 20-day MA (bullish) |

| MACD | 3.9567 | Positive momentum |

| Bollinger Bands | Upper: 122.7765 | Potential breakout target |

While risks remain, the combination of technical strength and positive news flow suggests LTC could be a good investment for those bullish on digital assets.

- Technical Strength: LTC is trading above key moving averages with bullish MACD momentum.

- Fundamental Catalysts: Rising merchant adoption and ETF speculation could drive further gains.

- Market Sentiment: Mixed but leaning bullish, with LTC outperforming in crypto payments.